Grow Your Revenue with Prepaid Debit Card Instant Issuance

What if you could make one change to your product offerings to potentially increase their activation and utilization, create a better customer experience, and simultaneously improve operational efficiencies? It turns out that it’s possible. By applying instant issuance to a prepaid debit card program, payment card providers could offer immediate satisfaction to their customers and […]

eReport | Launching a Card Program | How to navigate the journey

Click here to Download PDF Today’s payment card environment pulses with possibility. But with that potential comes a host of complexities. Credit and debit cards create unique challenges for the cardholder experience and compliance and security, so offering the right mix of solutions is vital. The goal for issuers is to create a card program […]

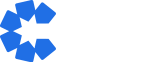

What are Small and Mid-Sized Financial Institutions (FIs) saying about their Sustainability initiatives & ESG responsibilities?

Click to Download PDF We asked executives at 106 different small and mid-sized FIs to tell us about their sustainability initiatives and how they view Environmental, Social, and Governance (ESG) responsibility. Learn the results in this infographic.

5 Card Program Strategies to Foster Your Sustainability Goals

Sustainability goals are influencing company identity and mission statements across industries, including the financial sector. Financial Institutions (FIs) of all sizes are setting sustainability goals, driven by a number of factors, including consumer demand for more eco-focused options. Since payment cards are a major touchpoint with customers, FIs are asking how cards can reflect those […]

Stay Competitive with Print-on-Demand: Establishing a Nimble Card Program

Print-on-demand personalized payment card strategies offer a way for credit and debit card programs to stay timely and targeted in an individualized market. Personalization matters in today’s highly competitive payments landscape and has become a high priority for credit and debit card issuers. When it comes to credit and debit card programs, making this leap […]

Discover Your Best Solution — 3 Types of Cloud-Based Instant Issuance Models

With today’s immediate gratification mindset, cardholders expect financial institutions (FIs) to be able to meet their needs with speed and convenience, and they want to be able to interact or conduct business in a branch. In fact, a 2021 CivicScience report found that the biggest determinant for choosing an FI remains how close a physical […]

Seal Your Prepaid Gift Card Program Against Fraud

Gift cards are a fast and fun way to spread holiday cheer, celebrate a birthday, a loved one, or many other “just because” moments. However, finding your gift card has been tampered with can spoil a special day. If you are a retailer preparing gift cards for the holiday season, you can include a first […]

Standing Out Through Sustainability in Cards

According to new research commissioned by CPI Card Group and produced by Aite Group, 80% of card issuers surveyed believe that cardholders are more environmentally conscious today than they were just five years ago. This belief is supported by sales of earth-friendly products having grown over five times faster than traditional products. Sustainability-marketed products accounted […]

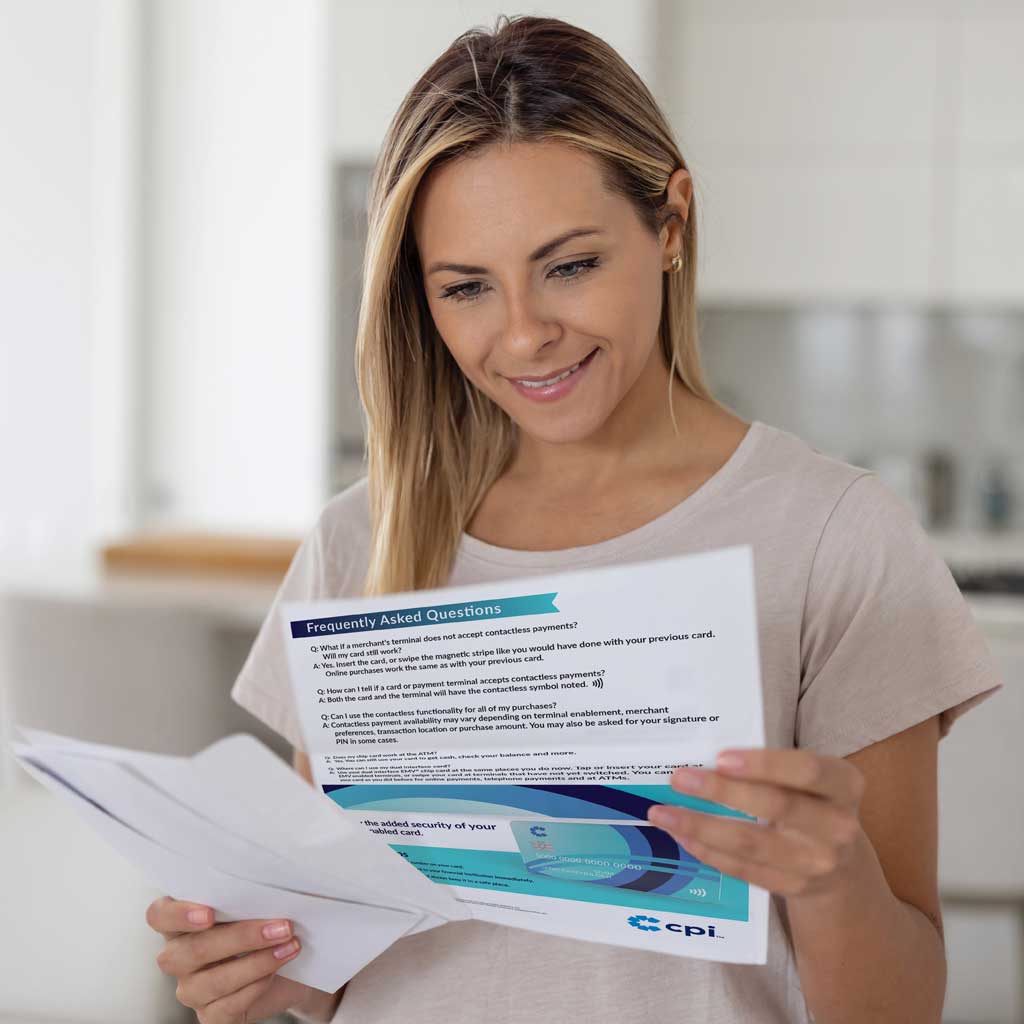

Ready to Roll with Instant Issuance? | 6 Reasons to Choose a SaaS Software Hosting Model

You’ve Decided to Offer Instant Issuance. Now What? You’ve decided (or are close to deciding) to offer your cardholders the ability to receive a new or replacement credit or debit card in-branch, quickly and conveniently. Now, you need to make a number of key decisions on how to build out your program. These decisions range […]

New Printing Option Makes Instant Issuance with Card@Once More Versatile

CPI Card Group® is excited to introduce Spectrum by Card@Once®, the company’s first retransfer printing solution for instant issuance. With the addition of Spectrum, issuers now have a premium Software-as-a-Service (SaaS) option for printing high quality debit and credit cards in branch and on demand to support an enhanced customer experience. Spectrum is a premium, […]